colorado estate tax form

DR 0096 - Request for Tax Status Letter. In reference to JDF 999 - Collection of Personal Property by Affidavit 15-12-1201 Colorado Bar Association Brochures.

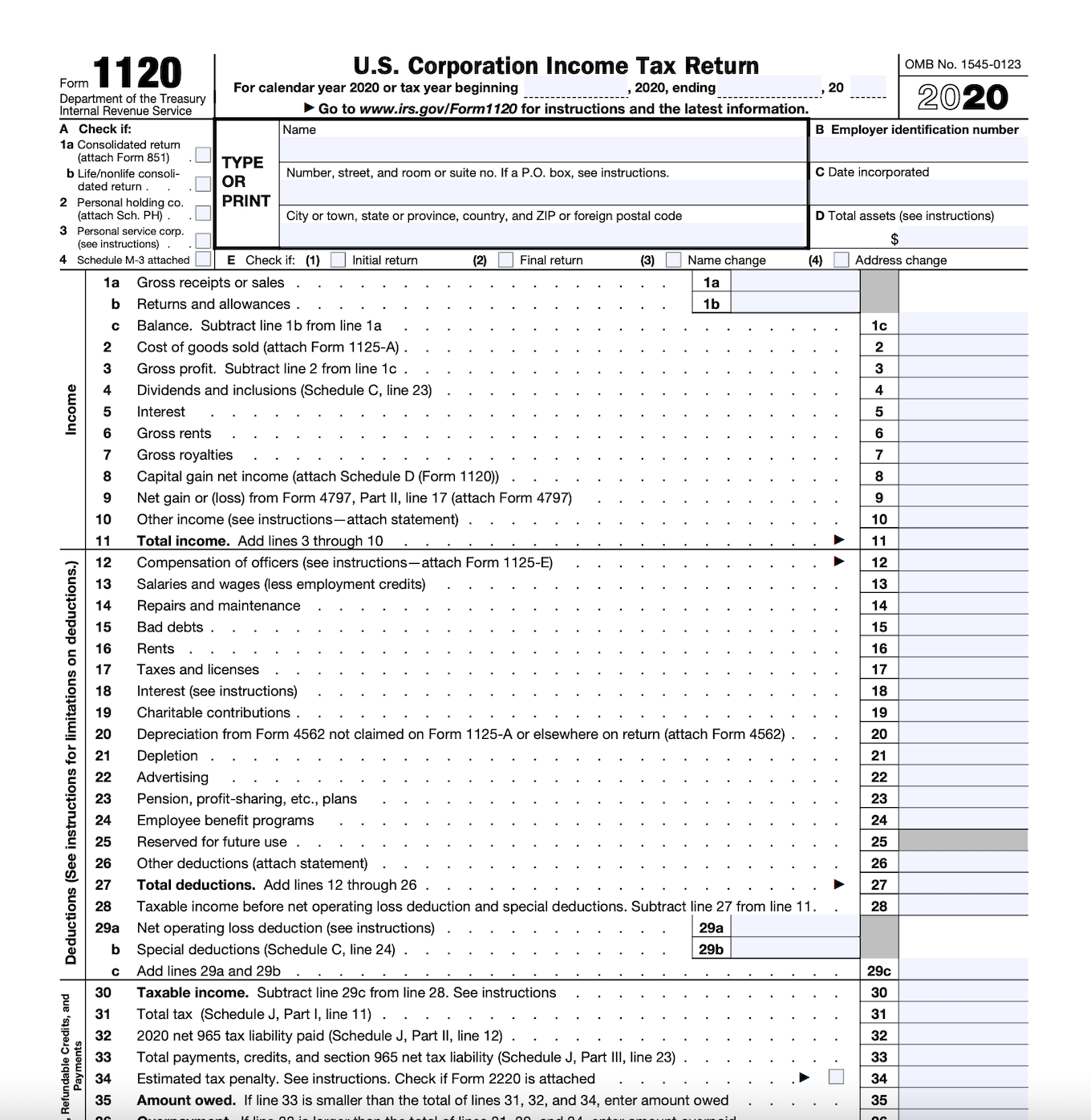

Form 1120 How To File The Forms Square

223 rows Sales Tax Return for Unpaid Tax from the Sale of a Business.

. Form DR 1210 is a Colorado Estate Tax form. If the date of death occurs prior to December 31 2004 Form DR 1210 must be filed. You must pay estimated income tax if you are self employed or do not pay sufficient tax withholding.

Nonresidents of Colorado who need to file income taxes in the state need to file Form 104PN. Application for an Affidavit Emissions Extension. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

All forms must be completed in English pursuant to Colorado law see 13-1-120 CRS. DR 1108 - Business Tax Account Closure Form. DR 0105 is a Colorado Estate Tax form.

Property taxes in Colorado are definitely on the low end. DR 1210 - Colorado Estate Tax Return. DR 0204 - Tax Year Ending Computation of Penalty Due Based on Underpayment of Colorado Individual Estimated Tax.

DR 0145 - Tax Information Designation and Power of Attorney for Representation. Get Access to the Largest Online Library of Legal Forms for Any State. DR 0104X - Amended Individual Income Tax Return.

Application for Low-Power Scooter Registration. DR 0158-F - EstateTrust Extension of Time for Filing. Real Property Transfer Declaration TD-1000 Real Property Transfer Declaration Completion Guide TD-1000 Government Assisted Housing Questionnaire.

Extension of Time for Filing Individual Income Tax Payment Form. Ad Download Fill Sign or Email the file More Fillable Forms Register and Subscribe Now. Under current law no Colorado estate tax filing is required for estates of individuals who die after December 31 2004.

DR 0158-I - Extension of Time for Filing Colorado Individual Income Tax. Extension of Time for Filling C Corporation Income Tax Payment Form. DR 1102 - Address or Name Change Form.

Instructions for Closing an Estate Formally Download PDF Revised 0919 JDF 958 - Instructions for Closing a Small. The IRS and most states will grant an automatic 6-month extension of time to file income tax and other types of tax returns which can be obtained by filing the proper extension request form. DR 0145 - Colorado Tax Information Authorization or Power of Attorney.

Hotel or Motel Mixed Use Questionnaire. DR 0253 - Income Tax Closing Agreement. DR 5782 - Colorado Electronic Funds Transfer EFT.

CO Income Tax Guide More Fillable Forms Register and Subscribe Now. Form 104PN - Nonresident Income Tax Return. Affidavit of Non-Commercial Vehicle.

DR 0105 - Colorado Fiduciary Income Tax Return form only DR 0158-F - EstateTrust Extension of Time for Filing. DR 0900 - Individual Income Tax Payment Form. DR 0102 - Deceased Taxpayer Claim for Refund.

The filing of the bankruptcy estates tax return does not relieve a debtor from the requirement to file his or her individual income tax return for Colorado income on the DR 0104. DR 0002 - Colorado Direct Pay Permit Application. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

Estimated tax payments are due on a. Extension of Time for Filing Estate or Trust Income Tax Payment Form. A property-tax exemption is available to senior citizens surviving spouses of senior citizens and one hundred percent disabled veterans For those who qualify 50 percent of the first 200000 in the actual value of their primary residence is exempted from property taxation The state pays the exempted portion of the property tax The.

State wide sales tax in Colorado is limited to 29. For Colorado returns the Fiduciary Income Tax Return is NOT used as a transmittal for the debtors form Individual Income Tax Return. DR 0137 - Claim for Refund - Withholding.

DR 0084 - Substitute Colorado W2 Form. DR 0900F - Fiduciary Income Payment Form. Additional information on filing can be found on the Colorado Department of Revenue website.

DR 8453 - Individual Income Tax Declaration for Electronic Filing. DR 8453F - Fiduciary Income Tax Declaration for Electronic Filing. DR 8453F - Fiduciary Income Tax Declaration for Electronic Filing.

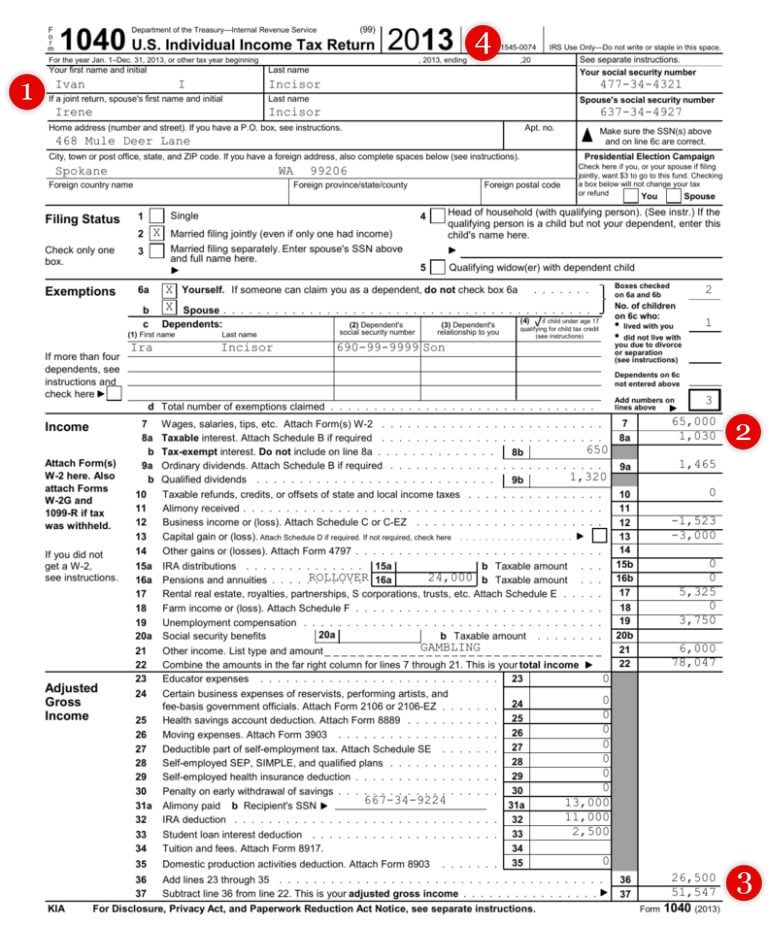

Affidavit of Non-residence and Military Exemption from Specific Ownership Tax. Obtaining an extension will prevent you from being subject to often very large failure-to-file penalties. Like the Federal Form 1040 states each provide a core tax return form on which most high-level income and tax calculations are performed.

So now you are a Conservator. Financial powers of Attorney. While some taxpayers with simple returns can complete their entire tax return on this single form in most cases various other additional schedules and forms must.

Application for Change of Vehicle Information IRP DR 2413. There are also in fact three cities in Colorado that assess a local income tax so make sure you check on your specific city. Form 104EP - Estimated Individual Income Tax Return.

DR 0900F - Fiduciary Income Payment Form. DR 0253 - Income Tax Closing Agreement. DR 0104EP - 2022 Individual Estimated Income Tax Payment Form.

DR 1210 - Colorado Estate Tax Return. DR 5714 - Request for Copy of Tax Returns. Estate tax revenue is subject to the spending.

Inventory and Accounting Forms Re-open Estate. They will average around half of 1 of assessed value.

Tax Pros Horrified By Irs Decision To Destroy Data On 30 Million Filers

How To Fill Out Form 1065 Overview And Instructions Bench Accounting

How To File Taxes For Free In 2022 Money

:max_bytes(150000):strip_icc()/1040-NR2021-59bde80441114cfa9cb43d182e899b8b.jpeg)

Form 1040 Nr U S Nonresident Alien Income Tax Return Definition

Pin By Kim Loeffler Mortgages Made On Mortgages Made Simple Mortgage Checklist Refinance Mortgage Mortgage

Tax Form Templates 5 Free Examples Fill Customize Download

Financial Tip Of The Month Tax Prep Checklist Tax Prep Checklist Tax Prep Small Business Tax

How Do New Construction Loans Work Construction Loans Home Financing New Home Construction

Pin By Grant Eagle On Estate Planning Real Estate Advice Financial Advice How To Plan

Form 12 12a Five Ways On How To Prepare For Form 12 12a Federal Income Tax Tax Forms Irs Taxes

/ScreenShot2020-02-03at1.41.37PM-322605a2b23a49598d9cdf9faee0a97a.png)

Form 706 United States Estate And Generation Skipping Transfer Tax Return Definition

Tax Form Templates 5 Free Examples Fill Customize Download

What Is A 1120 Tax Form Facts And Filing Tips For Small Businesses

Tax Form Templates 5 Free Examples Fill Customize Download

Understanding The 1065 Form Scalefactor

Tax Form Templates 5 Free Examples Fill Customize Download

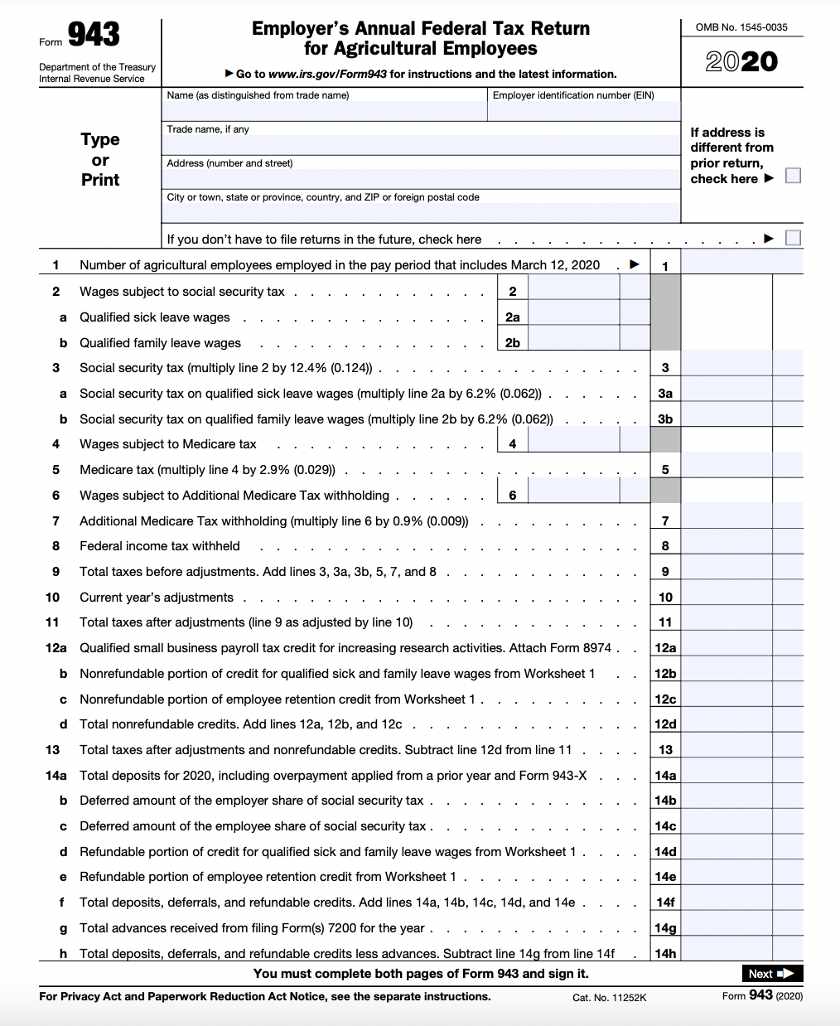

How To Fill Out Form 943 Step By Step Instructions Mailing Addresses